Is the Public Pensions System a Ponzi Scheme?

Let's dissect a cliché that is common in hard-right circles

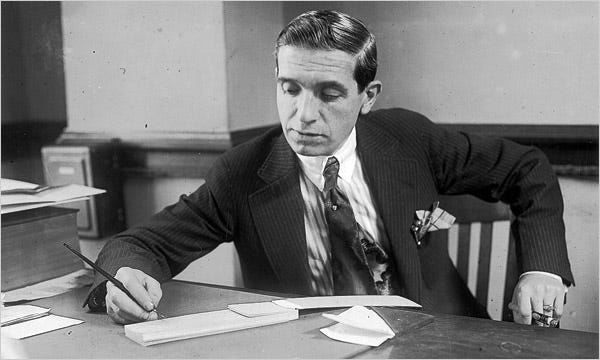

Charles Ponzi, by Boston Library (NYT); en.wikipedia.org - Boston Library (NYT); en.wikipedia.org, Public Domain, https://commons.wikimedia.org/w/index.php?curid=31534797

On 15th March, I published an essay challenging the hard right to find pro-natalist policies that actually work if its supporters want their anti-immigration narratives to be taken seriously. Stopping people from poorer countries moving to the West clearly risks crashing our pensions systems as populations age and the birth rate declines.

While there was a great discussion in the comments section, I noticed several members of the hard right making a point on social media, with slight variations: “Social Security is a Ponzi scheme.” Here is a news story on chainsaw-wielding hard-right guru Elon Musk saying that the US Social Security system, which runs the pensions system, is “the biggest Ponzi scheme of all time.”

As is often the case with clichés, there is an element of truth to it. Pensions really do share certain characteristics with pyramid schemes, which are often tagged after Charles Ponzi, an Italian charlatan who conned people in North America in the 1920s. His scams were originally known as “robbing Peter to pay Paul,” which is actually a better name than a Ponzi scheme. The idea is to pay profits to earlier investors based on funds from more recent investors.

Of course, most state-backed pensions systems are set up so current taxpayers cover the liabilities owed to current retirees. When the time comes for the taxpayer to retire, future generations are supposed to pick up the baton. There is a contrast with private pensions, where investors slowly build a personal pot of money.

Having said that, there are also several major differences between pensions and Ponzi schemes. Not least, Ponzi schemes are fraudulent by their very nature, not to mention being illegal. Con artists who specialise in pyramid schemes will often go blue in the face trying to pretend that the scam is something legitimate. In reality, though, they lack real products or services. This is not the case with state-backed pensions, which are both set up in a transparent way and are legal.

Another major difference is that pensions are state backed, while Ponzi schemes are run by outsiders. The state has a lot of levers to pull if the numbers stop working well. The government can implement policies to encourage young couples to have more kids (assuming it can find policies that actually work); it can encourage immigration if the birth rate continues to fall; it can seek to raise the retirement age; and it can cut or freeze pension rates. Far-sighted governments can also set up sovereign wealth funds with a mandate to build investments that can support future pensions liabilities.

Taken together, these differences suggest a major difference, which means that the cliché is seriously misleading. Pyramid schemes inevitably collapse. The market for Ponzi schemes is finite, but they will always reach a point when they can no longer grow. A state-backed pensions system is different. It might be unstable, but it is unstable the same way that riding a bicycle is unstable: you might never be perfectly balanced, but if you keep moving forwards and making small adjustments, you are likely to be fine.

Economic growth is the secret ingredient here. Compound growth is not linear. Even if growth rates stay the same, future levels of growth will be based on the new, larger baseline. Over long periods of time, compound growth will tend to look like exponential growth (the proverbial hockey stick, which is much loved in Silicon Valley). In other words, an economy that grows steadily over decades should be able to support pensions liabilities.

Of course, relying on the cliché means that members of the hard right don’t have to grapple with difficult questions. Do you think the pensions system will collapse at some point? If it does collapse, will voters blame the incumbent government of the time? If the system collapses on your watch, what is the plan to keep your movement alive afterwards? The comments are open. See you next week!

Previously on Sharpen Your Axe

Compound growth (part one and part two)

Exponential growth (part one and part two)

Further Reading

Empty Planet: The Shock of Global Population Decline by Darrell Bricker and John Ibbitson

This essay is released with a CC BY-NY-ND license. Please link to sharpenyouraxe.substack.com if you re-use this material.

Sharpen Your Axe is a project to develop a community who want to think critically about the media, conspiracy theories and current affairs without getting conned by gurus selling fringe views. Please subscribe to get this content in your inbox every week. Shares on social media are appreciated!

If this is the first post you have seen, I recommend starting with the fourth-anniversary post. You can also find an ultra-cheap Kindle book here. If you want to read the book on your phone, tablet or computer, you can download the Kindle software for Android, Apple or Windows for free.

Opinions expressed on Substack and Substack Notes, as well as on Bluesky and Mastodon are those of Rupert Cocke as an individual and do not reflect the opinions or views of the organization where he works or its subsidiaries.

I think it's slightly simplistic to argue that state pensions schemes are automatically sustainable just because they're guaranteed by the state, particularly when we can see that post-industrial sociaties are on a path to gerontocracy embedded in short-termist political systems which discourage the implementation of necessary reforms

A timely piece considering how MAGA is gearing up for an assault on everyone’s hard earned state retirement benefits. Stay tuned!